unemployment benefits tax refund status

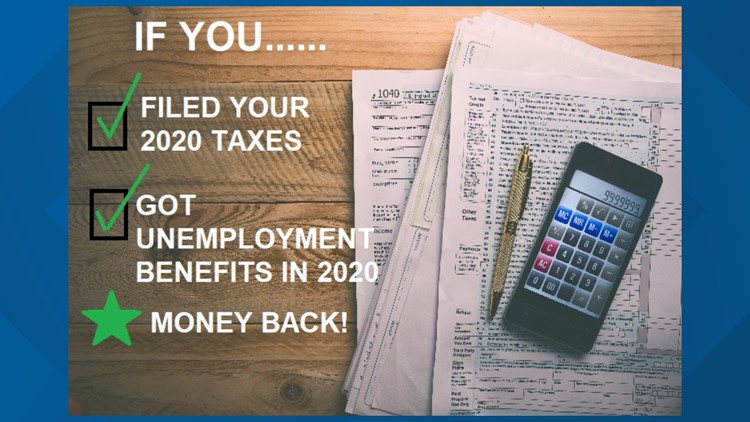

Depending on the type of. The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment.

Irs Will Automatically Refund Taxes Paid On Some 2020 Unemployment Benefits Ds B

If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check.

. File an Unemployment Claim. Tax form 1099-G tells you how much unemployment income you received. You can check the status of your current year refund online or by calling the automated line at 260-7701 or 1-800-218-8160.

Income Tax Refund Information. You wont be able to track the progress of your refund through the. In observance of the state and federal holiday IDES offices will be closed on Monday September 5th.

IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer. Repeals state and local income taxes on unemployment insurance benefits for the 2020 and 2021 tax years for claimants who meet certain household income requirements. A quick update on irs unemployment tax refunds today.

COVID Tax Tip 2021-87 June 17 2021 The IRS is reviewing tax returns filed before the American Rescue Plan of 2021 became law in March to determine the correct taxable. You must report all unemployment benefits you receive to the IRS on your federal tax return. If you are receiving benefits you may have federal income taxes withheld from your.

To apply for regular unemployment insurance click the button below. This may result in benefit payment taking longer to process but you. The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their.

Illinois residents who received unemployment benefits in 2020 and filed their income taxes before March 15 can expect refunds from the Illinois Department of Revenue as. ILLINOIS Over 300000 Illinois residents who received unemployment and filed their income taxes before March 15 may be eligible for refunds from the Illinois Department of. If you are eligible for the extra refund for federal tax that was withheld from your unemployment the IRS will be sending you an additional refund sometime during the next.

Report this amount when you file your federal and state tax returns. Youll be taken to the 10 Things You Should Know page to start the application process.

Unemployement Benefits Are This Payments Taxable Marca

Tax Issues With Unemployment Benefits Get More Complicated Wgrz Com

Will My Unemployment Benefits Affect My Tax Refund Gudorf Tax

Unemployment Benefits And Taxes Here S What To Do About Incorrect Tax Forms And Other Issues The Denver Post

Some May Receive Extra Irs Tax Refund For Unemployment

Irs To Send Another 4 Million Tax Refunds To People Who Overpaid On Unemployment Cbs News

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

More Irs Refunds Are On The Way How Unemployment Figures In Wfmynews2 Com

Recipients Of 2020 Unemployment Benefits May Be Eligible For Arizona Income Tax Refund San Tan Valley News Info Santanvalley Com

Irs Sends Out Average 1 600 Unemployment Adjustment Refunds Wfmj Com

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment The Us Sun

Covid 19 Stimulus Deal How The 10 200 Unemployment Tax Waiver Works

Dor Unemployment Compensation State Taxes

Michigan Department Of Treasury Don T Wait To File Your Individual Income Tax Returns

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Unemployment 10 200 Tax Credit Irs Begins Refund In May If You Filed

Your Unemployment Tax Refund Is Coming In May Irs Says Here S How To Get Yours Nj Com